ABOUT US

Kah Capital Management, LLC (“KCM”) is a leading minority-owned investment management firm focused on mortgage credit.

Our “Do Well and Do Good” investment strategy targets attractive returns while prioritizing home retention for “at risk” families.

OUR VALUES

Innovation

Integrity

Accountability

Diversity

Social Responsibility

LEADERSHIP TEAM

The principals are leaders with extensive experience in mortgage credit and all aspects of residential mortgage investing and risk management. Each executive team member has over 20 years experience at top tier financial institutions.

Adama Kah is founder, CEO and Chief Investment Officer at Kah Capital (“KCM”). He launched KCM in 2018. He has over 20 years of experience in mortgage related investments spanning Freddie Mac, the buy side and sell side on Wall Street in senior roles that include investment management, risk management and portfolio strategy. He has a strong track record of innovation, leadership, building and managing high performing teams.

Prior to forming KCM, he ran Freddie Mac’s $130+ billion distressed mortgage portfolio and was a member of the core team that developed and brought to market the first GSE Credit Risk Transfer (STACR) transactions following the financial crisis. Prior to that, he ran Freddie Mac’s $100 billion adjustable-rate mortgage (ARM) trading desk. Through the course of his career in investment management, he has also held senior roles on the buy side (Times Square Capital Management) and sell side (Credit Suisse) of Wall Street. Adama currently serves as a member on the board of directors of the Structured Finance Association (SFA).

Adama received a BS in Electrical Engineering and an MS in Quantitative Finance both from The George Washington University, where he was also a member of the men’s nationally ranked basketball team. He is the founder and president of The KEO Foundation, a non-profit organization focused on uplifting the underprivileged especially in sub-Saharan Africa.

Devajyoti (Doc) is co-founder and Managing Director at Kah Capital. Like Adama, he has a keen interest in all aspects of mortgage investments and risk management with a special interest in mortgage analytics developed over a period of 20+ years at Freddie Mac. He is member of the Kah Capital Management leadership team and works closely with Adama and Chandra. As part of the leadership team, he is responsible for setting strategy on risk management and predictive analytics.

Doc retired from Freddie Mac in early 2018, where he held senior leadership positions over his 20 years at the firm. Doc was a member of Freddie Mac’s Management Committee and Head of Freddie Mac’s $850 billion Capital Markets Division and Treasurer. As Treasurer, he was responsible for managing debt issuance, Freddie Mac’s liquidity position and interest rate risk hedging for the entire firm. He was also Head of Models and Portfolio Analytics for the Capital Markets Division. Prior to Freddie Mac, Doc was assistant professor of Economics at the University of Arizona where he taught economics and econometrics and engaged in research in econometrics from 1990-1997.

Doc received an M.A. in Economics from the Delhi School of Economics in India and PhD in Econometrics from the University of California at San Diego. He has served on the Risk Committee of the Chicago Mercantile Exchange (CME) and the Investment Committee of the University of California at San Diego (UCSD) Foundation.

Chandra is co-founder and Managing Director at Kah Capital. He leads the development of the firm’s quantitative models and analytical platform. He has over 20 years of experience in mortgage related investments, research and analytics.

Prior to joining Kah Capital, Chandra was at Pretium, where he was responsible for the firm’s Real Estate Quantitative strategies focusing on distressed US mortgage credit, including re-performing and non-performing loans and house price models. He also worked on the firm’s Single Family Rental (SFR) platform. Prior to Pretium, Chandra ran the Non-Agency Residential Mortgage and Asset Backed Securitization Strategy desk at Credit Suisse. Chandra began his career at Bear Stearns.

Chandra received a BTech in Engineering from the Indian Institute of Technology (IIT) and an MS in Industrial and Management Systems Engineering from the University of Nebraska Lincoln.

Donna is the Chief Operating Officer of Kah Capital and a member of the Management Committee. She leads marketing strategy, business development, client service and other administrative duties. Donna has a unique combination of legislative, regulatory and international experience gathered over 30 years in investment banking and asset management. Prior to joining Kah Capital, she was President of Smith Graham Investment Advisors.

Donna began her career in mortgages at Bear Stearns where she was a Vice President and sold mortgage-backed securities. Her subsequent investment banking experience includes leading roles in underwriting billions of dollars of corporate and mortgage debt and equity public offerings. She was Executive Vice President of CastleOak Securities, L.P., President of M.R. Beal & Company and a Co-Founder of Loop Capital Markets where she was responsible for each firm’s participation in the securitization programs of the Government Sponsored Enterprises, the FDIC, the NCUA and the Resolution Trust Corporation as well as the Federal Reserve Bank of New York’s first residential loan sale, Maiden Lane 2012-1. During the Great Financial Crisis, Donna worked closely with the US Congress and key regulatory agencies to ensure diverse firm participation in capital market transactions.

Donna currently serves on the Board of Directors of FuelCell Energy (NASDAQ:FCEL) where she is a member of the Audit, Compensation and Nominating, Governance and ESG Committees. Donna’s community outreach includes membership of the Executive Committees of the Greater Houston Partnership and the United Way of Greater Houston. She is a former member of Fannie Mae’s National Advisory Council, a former Chair of the Export Import Bank of the United States Sub Saharan Africa Advisory Board and former Chair of the Board of the National Association of Securities Professionals as well as Chair of its Legislative Committee for 13 years.

Donna received her Bachelor of Arts degree in Political Science from Yale University.

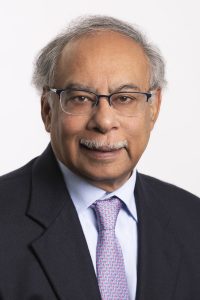

Sanjay Malhotra is the Chief Financial Officer (CFO) and Chief Compliance Officer (CCO) at Kah Capital Management. He has over 20 years of experience in leadership roles the financial services industry.

Prior to Kah Capital, Sanjay was COO/CFO/CCO and Fund Advisor at DPM Capital LLC. Prior to that, he held senior roles at SECOR Asset Management, including as CFO and CCO at SECOR Asset Management and as COO (Chief Operating Officer) at SECOR Capital Advisors. Before SECOR, Sanjay was also Principal at Investcorp, responsible for monitoring operational risk for the firm’s hedge fund portfolio, which includes operational due diligence, background checks, monitoring of adherence to investment guidelines and independent valuation of the portfolio. Prior to Investcorp, he was a Portfolio Accountant at the Abu Dhabi Investment Authority and also worked as auditor with Ernst & Young in Qatar.

Sanjay holds a BA (Hons) in Commerce from the University of Delhi, India. He is an Associate Chartered Accountant (ACA) from the Institute of Chartered Accountants of India.

KEY DIFFERENTIATING FACTORS

- “Do Well and Do Good” strategy

- Data driven servicing oversight platform built to scale easily

- Experience and deep relationships across the mortgage credit ecosystem

- Leading African-American owned investment firm in mortgage credit